The Emerging Disruption of Affordable GLP-1 Medications in Global Healthcare and Consumer Markets

The rapid development and expanding accessibility of glucagon-like peptide-1 (GLP-1) receptor agonists, primarily used for obesity and Type 2 diabetes treatment, hint at a significant weak signal that could reshape healthcare, pharmaceutical economics, and consumer lifestyles worldwide. Increasing approvals, pricing reforms, and generic developments suggest a future where these drugs may shift disease management paradigms, influence payer and provider behaviors, and ripple through food, wellness, and insurance industries. This article examines the novel trajectory of GLP-1 medicines becoming more affordable and widespread, an aspect often overshadowed by headline obesity rates and pharmaceutical innovation alone.

What’s Changing?

GLP-1 receptor agonists, including leading drugs like Wegovy and Ozempic, were initially approved to manage Type 2 diabetes but have gained prominence for their weight loss and cardiovascular risk reduction benefits. Recently, health authorities across various countries have introduced significant policy and market shifts to enhance access and affordability.

For example, in the United States, Medicare announced pricing reforms capping beneficiary copays for injectable GLP-1 medications at $50 per month—a stark reduction from current market prices that can reach upwards of $245 per month (Chess Health Solutions). This move signals a systemic shift toward wider insurance coverage and the normalization of these medications in chronic disease management.

Internationally, in Canada, Health Canada is reviewing nine generic versions of semaglutide (the active ingredient in Ozempic and Wegovy), which could dramatically reduce prices and increase demand (The Star). Similarly, Australia plans to subsidize Wegovy for individuals with severe obesity and prior major cardiovascular events, further extending access (ABC News).

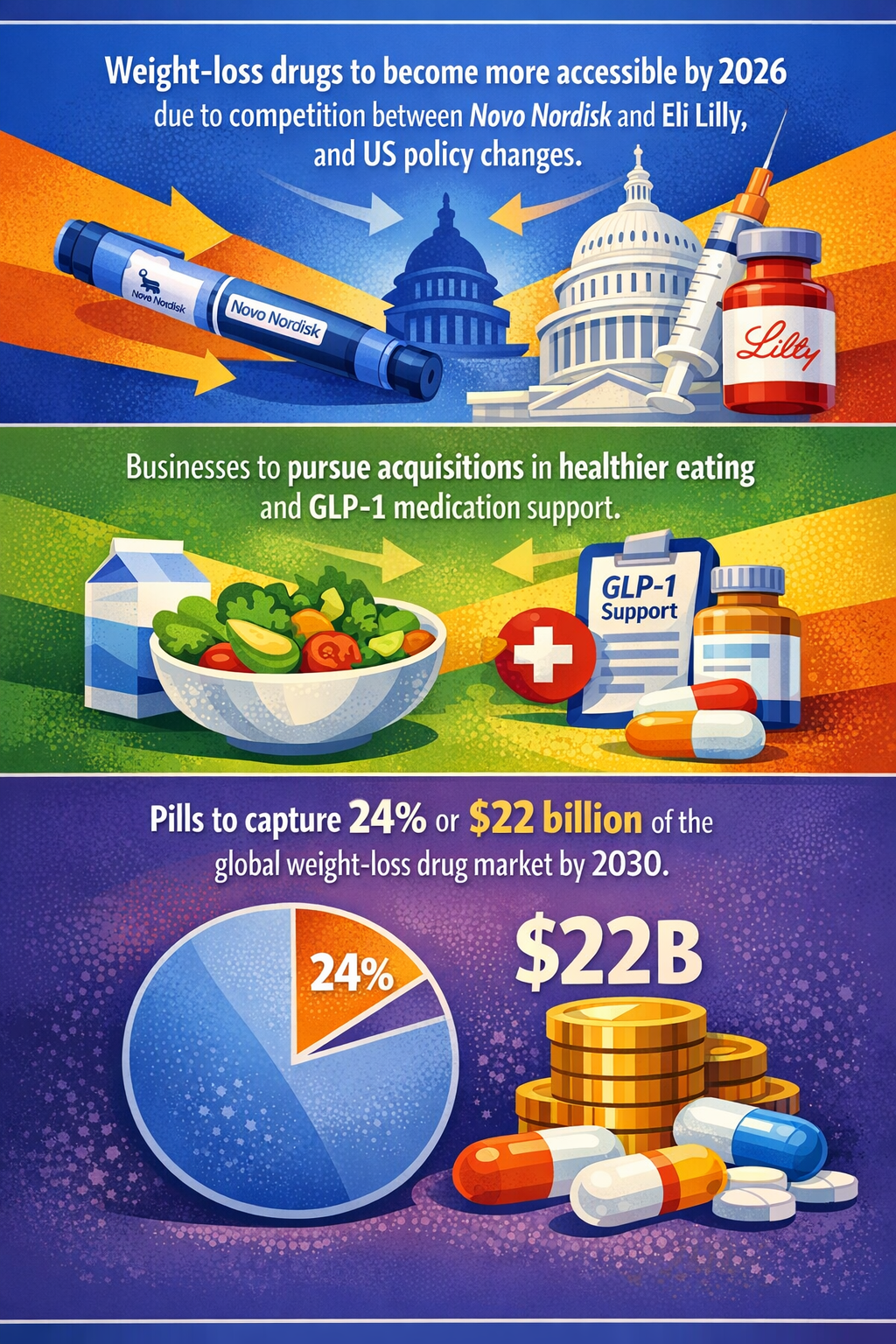

The drug market dynamics are also evolving due to intense rivalry between pharmaceutical giants like Novo Nordisk and Eli Lilly to dominate the GLP-1 space. This competition is catalyzing advancements in drug formulations, delivery convenience, and price wars, with political figures engaging directly to negotiate price reductions (Business of Fashion).

Regionally, the Middle East and North Africa (MENA) shows rapid growth potential, with GLP-1 revenues expected to more than double between 2024 and 2030, driven largely by increasing obesity prevalence and government healthcare spending shifts (Fast Company ME).

Beyond pharmaceuticals, businesses in food and beverage sectors are adjusting to this shift by broadening their product portfolios to cater simultaneously to healthier diets and support GLP-1 medication regimes. This reflects an emerging synergy between medical treatments and lifestyle industries (Food Dive).

Why is this Important?

These recent developments suggest a disruptive shift in healthcare delivery and consumer health behavior. More affordable and accessible GLP-1 drugs may transform obesity and diabetes management from a fragmented, costly intervention to a routine pharmaceutical approach accessible to wider populations. This change could help stem the growth of chronic disease mortality related to cardiovascular issues while challenging existing healthcare budgets and insurance models.

Drops in price and broadening insurance coverage may stimulate demand beyond current constraints, impacting healthcare providers' prescribing patterns and drug supply chains. This may intensify pressures on healthcare systems to balance cost, access, and long-term outcomes.

In the consumer landscape, the expanding use of GLP-1 drugs to regulate appetite and body composition may reshape dietary behaviors and expectations. Coupled with food industry responses, this could disrupt traditional food consumption patterns and wellness product markets. Corporations might face pressure to innovate or consolidate to align with new health-conscious consumer behaviors supported by pharmaceutical intervention.

From a policy perspective, governments may encounter budget reallocations as they subsidize these costly medications. However, if managed well, long-term reductions in cardiovascular events and other obesity-related complications could yield net economic benefits by lowering hospitalizations and improving workforce productivity.

Implications

The affordability and mainstreaming of GLP-1 medications create complex, multi-industry effects. Strategic planners in healthcare, insurance, pharmaceuticals, government, and consumer sectors might consider the following implications:

- Healthcare systems may need to adapt clinical guidelines and infrastructure to accommodate increased GLP-1 treatment volumes, including training for appropriate prescribing and monitoring to ensure effective use and minimize adverse events.

- Payers and insurers must model budget impacts and long-term cost-benefit scenarios for covering GLP-1 therapies, balancing upfront drug expenses against potential savings from reduced cardiovascular and metabolic complications.

- Pharmaceutical companies may face intensified generic competition and pricing pressures, necessitating diversification strategies, investments in novel formulations, or vertical integration with consumer health and wellness markets.

- Food and beverage industries could encounter shifting consumer demands influenced by appetite-regulating medications, prompting innovation in product ingredients, marketing strategies, and health-oriented portfolio expansion.

- Governments and policymakers should consider holistic approaches that integrate pharmaceutical access, public health campaigns, and nutrition policies to optimize population health outcomes effectively.

These interlinked shifts may foster new collaborations, mergers, and regulatory frameworks spanning healthcare, consumer goods, and policy sectors, with the potential to disrupt traditional boundaries and business models.

Questions

- How will healthcare providers balance increased demand for GLP-1 therapies with monitoring and managing long-term patient adherence and outcomes?

- What innovative financing or insurance models could absorb the short-term costs while capitalizing on the long-term savings offered by broader GLP-1 medication coverage?

- In what ways might food and beverage companies anticipate and respond to changes in consumer appetite and dietary behaviors correlated with GLP-1 use?

- Could government health policies integrate GLP-1 medication accessibility with preventive health programs to create synergistic population health improvements?

- How might emerging markets and low-income regions participate in or be excluded from the expanding GLP-1 pharmaceutical transformations?

Keywords

GLP-1 medications; obesity treatment; pharmaceutical pricing; cardiovascular disease; generic drugs; healthcare insurance; consumer health; food industry innovation

Bibliography

- Wegovy is approved to lower the risk of cardiovascular death, heart attack, and stroke in certain adults with cardiovascular disease. Solv Health. https://www.solvhealth.com/health/wegovy-for-weight-loss

- The rapid rise in prescriptions for GLP-1 medications to help treat obesity and reduce weight-related health risks is transforming the dietary patterns, appetite regulation and body composition for people around the world. Pharmaceutical Manufacturer. https://pharmaceuticalmanufacturer.media/pharmaceutical-industry-insights/pharmaceutical-manufacturing-insights/2026-trends-predictions-experts-insights-across-pharma/

- In the UAE alone, GLP-1 revenues are expected to more than double between 2024 and 2030, growing at roughly 14% a year from a 2024 base of $137 million - a trend already impacting payer budgets and provider prescribing patterns. Fast Company ME. https://fastcompanyme.com/impact/obesity-is-a-public-health-crisis-in-mena-but-how-much-is-it-costing-the-economy/

- Under the announced framework, Medicare pricing for injectable GLP-1 medications will be set at approximately $245 per month, with beneficiary copays capped at $50. Chess Health Solutions. https://www.chesshealthsolutions.com/2026/01/13/medicares-new-glp-1-pricing-initiative-signals-a-shift-in-coverage/

- Popular drugs used for weight-loss and Type 2 diabetes could soon become far more affordable across Canada, as Health Canada reviews nine generic versions of semaglutide medications - the active ingredient in drugs like Ozempic and Wegovy. The Star. https://www.thestar.com/news/canada/weight-loss-drug-prices/article_cb9ada4b-c341-4399-aa01-31bdfc32b702.html

- The cost of weight loss drug Wegovy will soon be massively subsidised for Australians with severe obesity who have had a stroke or heart attack. ABC News. https://www.abc.net.au/news/2026-01-12/wegovy-to-be-added-to-pbs/106218104

- Businesses will seek acquisitions that broaden their appeal to consumers in areas such as healthier eating or supporting the use of GLP-1 medications to lose weight. Food Dive. https://www.fooddive.com/news/food-beverage-trends-2026/809061/

- Between Novo Nordisk and Eli Lilly's global battle to own the GLP-1 category, and US president Donald Trump striking a deal to slash prices, weight-loss drugs will become more accessible and convenient in 2026. Business of Fashion. https://www.businessoffashion.com/articles/beauty/wellness-beauty-themes-2026/

- The price of drugs like Ozempic may soon drop dramatically in Quebec after a patent expired, which experts predict could cause a surge in demand for the popular weight-loss medication. Montreal Gazette. https://montrealgazette.com/news/health/why-generic-ozempic-could-soon-become-a-lot-cheaper-in-quebec