The Emergence of Climate Finance Digital Ecosystems as a Disruptive Force

Climate finance is poised to evolve beyond traditional investment and regulatory frameworks into digital ecosystems that integrate sustainable finance, carbon markets, and climate risk management. A weak but growing signal lies in the confluence of increasing climate finance targets, digital financial innovation, and emerging carbon credit expansion. This digital evolution could disrupt how governments, businesses, and financial institutions mobilize capital, allocate risk, and measure impact over the coming decades.

Introduction

Global commitments to climate finance mobilization are scaling up, targeting US$1.3 trillion annually by 2035 to meet adaptation and mitigation needs (ISS Africa). Parallel to these targets, financial innovation in digital assets and climate-linked products is accelerating (Maxthon). Significantly, over half of corporations plan to increase use of carbon credits by 2030, signaling maturation of voluntary markets (EcoAct). This article explores how nascent digital ecosystems encompassing carbon markets, climate finance flows, and sustainable investing could reshape multiple sectors. It analyzes the weak but consequential signals around digital integration of climate finance, carbon credits, and risk assessment that may form a foundational infrastructure for the global low-carbon transition.

What’s Changing?

Climate finance targets have intensified, with international agreements now aiming for US$1.3 trillion yearly by 2035 (ISS Africa). This is a substantial increase from approximately US$450 billion deployed annually in developing countries in 2019, which was only around 20% of projected needs (Institute Global). The scaling of finance clearly signals a deepening urgency but also exposes gaps in coordination and transparency.

India’s current lack of a formal National Climate Finance Strategy illustrates the institutional lag in aligning fiscal policy, financial regulation, and capital mobilization to effectively manage these growing funds (Policy Circle). This gap indicates future opportunities for infrastructure that better integrates policymaking with market mechanisms.

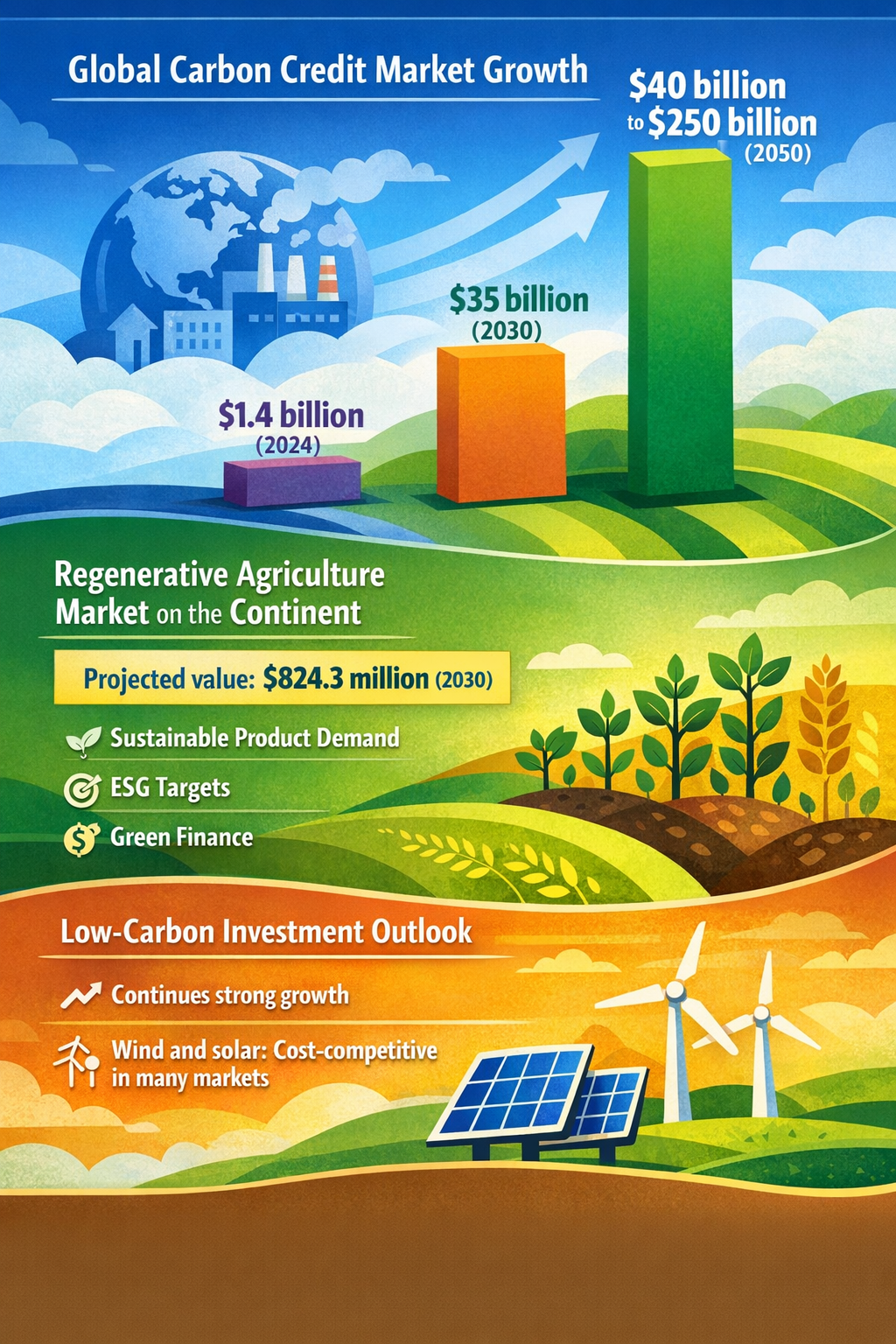

Corporations increasingly anticipate expanding their use of carbon credits, with more than half planning to do so by 2030, reflecting rising confidence and appetite for engagement in carbon markets (EcoAct). This anticipated scale-up suggests a maturing voluntary carbon market in which digital platforms may play a critical role by enabling real-time tracking, verification, and transaction of credits.

Financial innovation is accelerating in Asian markets such as Singapore, which aspires to lead in sustainable finance and digital asset development (Maxthon). Digital tokens and blockchain-based platforms could form the technological backbone for transparent and efficient climate finance ecosystems, linking stakeholders from governments to private investors and project developers.

According to Moody’s 2026 Outlook, low-carbon investments like wind and solar are increasingly cost-competitive, potentially attracting larger pools of diversified capital. This may catalyze further integration of sustainable finance products with digital risk analytics increasingly embedded in insurance and asset management (Gulf News).

Despite these positive signals, challenges in revenue mobilization persist. For example, the New Collective Quantified Goal aims to channel US$300 million annually in public climate finance to developing countries by 2035 but progress is expected to be slow (The Assay). This underlines the need for mechanisms that can efficiently pool, allocate, and track funds across national and private actors—a function digital ecosystems could increasingly fulfill.

Finally, the geopolitical landscape is complex, with countries like India navigating nuanced positions—potentially aligning with Western stances on maritime security but collaborating with China on climate finance (Medium). This diversity of interests points to the potential of decentralized, interoperable digital finance networks that accommodate varied governance priorities without reliance on traditional centralized institutions.

Why is this Important?

This convergence of increased climate finance ambitions, corporate carbon market participation, and digital financial innovation may drive structural shifts in how climate-related capital and risk are managed globally. If developed, climate finance digital ecosystems could:

- Improve transparency and traceability of funds, reducing inefficiencies and increasing trust among stakeholders.

- Enable real-time monitoring and verification of carbon credit issuance and retirement, enhancing market integrity.

- Facilitate more rapid and tailored mobilization of capital to climate adaptation and mitigation projects, especially in developing countries.

- Integrate risk assessment with insurance and investment underwriting, promoting resilience in low-carbon sectors.

- Lower transaction costs by automating processes via blockchain or distributed ledger technologies, attracting more diverse investors.

In effect, these ecosystems could disrupt traditional climate finance systems, which tend to be fragmented, opaque, and slow. They may also redefine the roles of governments, international organizations, private investors, and service providers, necessitating new governance models and cross-sector collaboration frameworks.

Implications

Businesses, governments, and financial organizations should prepare for the potential emergence of climate finance digital ecosystems by:

- Investing in digital infrastructure: Developing platforms for transparent reporting, carbon credit tracking, and secure transaction mechanisms may become a strategic imperative.

- Reevaluating risk management: Incorporating climate risk data and digital verification methods can improve underwriting and investment decision-making in insurance and banking sectors.

- Adapting governance approaches: The decentralized nature of digital ecosystems may require new regulatory frameworks that balance transparency, data privacy, and flexibility.

- Building cross-sector partnerships: Collaboration between technology firms, financial institutions, governments, and climate projects will be necessary to harmonize standards and interoperability.

- Enhancing capacity in developing countries: Digital climate finance could provide scalable tools for managing inflows and demonstrating impact, but local institutional readiness must improve to realize benefits fully.

If ignored, stakeholders risk being sidelined as emerging ecosystems redefine market participation criteria and operational models. However, early engagement can unlock new funding sources, streamline capital allocation, and amplify climate action impact.

Questions

- How might digital assets and blockchain technology transform transparency and trust in climate finance and carbon markets?

- What new governance and regulatory mechanisms will be needed to oversee decentralized climate finance ecosystems?

- How can financial institutions integrate real-time climate risk data into underwriting and investment decisions effectively?

- What role should governments play in ensuring equitable access to and benefits from digital climate finance platforms, especially in the Global South?

- How might geopolitical complexities influence collaboration and standard-setting for global digital climate finance systems?

- What partnerships between technology providers, finance actors, and climate initiatives are critical to accelerate ecosystem development?

- What are the risks of digital exclusion within climate finance, and how can they be mitigated?

Keywords

climate finance; carbon credits; digital assets; sustainable finance; blockchain; climate risk management; voluntary carbon market

Bibliography

- There was some movement on the climate finance target - now at US$1.3 trillion yearly by 2035, with adaptation finance tripled. ISS Africa

- As of 2019, $450 billion of climate finance was deployed annually in countries in the Global South, roughly 20% of what is needed by 2030. Institute Global

- India still lacks a formal National Climate Finance Strategy, which could align fiscal policy, financial regulation, and private capital mobilization. Policy Circle

- According to Moody's Sustainable Finance 2026 Outlook, low-carbon investment will continue, as wind and solar are cost-competitive in many markets. Gulf News

- More than half plan to expand carbon credit use by 2030, signalling rising confidence, appetite and capacity to engage. EcoAct

- The transition toward sustainable finance, digital assets, and innovative financial products creates opportunities for Singapore to extend its leadership. Maxthon

- Revenue mobilization would be slow towards the New Collective Quantified Goal - a target agreed in 2024 to provide developing countries with US$300 million of climate finance from public sources per year by 2035. The Assay

- India might side with the West on South China Sea freedom of navigation but with China on climate finance. Medium